Aussie travellers costing the government $500 million through GST loophole

Aussie travellers have managed to cheat the taxation department out of more than half a billion dollars through the Tourist Refund Scheme (TRS).

The Australian National Audit Office (ANAO) has produced a report questioning the management of the scheme, concluding there is evidence of mass non-compliance from Australians causing a “significant revenue leakage” to the tune of between $244.3 million and $556.6 million over the 20-year life of the scheme.

Under the TRS, travellers leaving Australia can claim a refund of the goods and services tax (GST) and wine equalisation tax (WET) they paid on goods purchased in Australia within the previous 60 days.

Around 60 countries worldwide also have such schemes, however, Australia is the only country that allows its citizens and residents to participate.

According to the report, while the ATO and the Department of Home Affairs do not consider policing the TRS as a priority, its use is growing rapidly, with more than $1.6 billion in refunds being paid out since July 2000, 41 per cent of which was paid to Australians.

However, the refund works on the assumption the goods claimed will be exported, but some crafty Aussies are claiming on goods they will bring them back with them when they return.

The report suggests stronger systems should be put in place to oversee the management of the scheme.

“Home Affairs can place alerts on returning Australian citizens and residents where it suspects that goods may be reimported without being declared,” it reads.

“However, although this has produced a ‘hit’ rate of 41.9 per cent when it has been used, it is used relatively infrequently.”

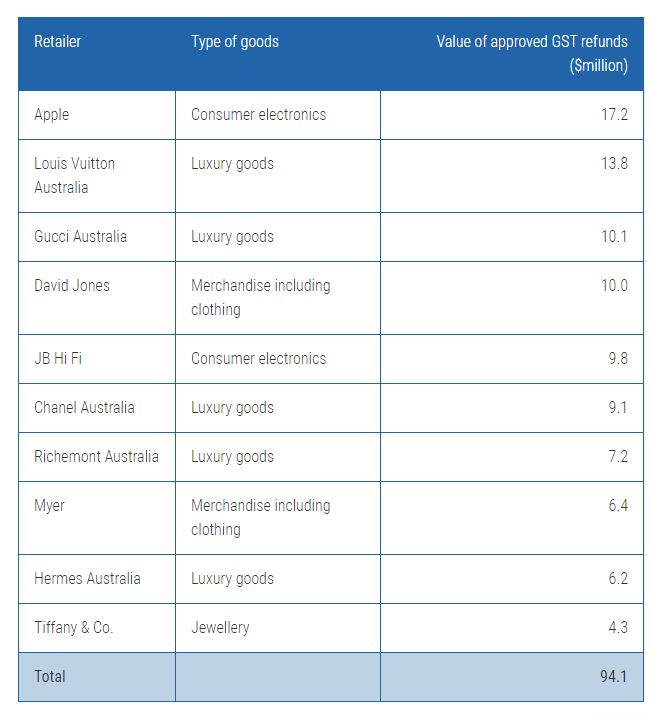

According to ANAO, luxury items and electronics are the most common types of goods claimed, with $17.2 million dollars in Apple products claimed, $13.8 million worth of Louis Vitton, $10.1 million on Gucci and $10 million on David Jones.

Source: ANAO analysis of TRS data.

Labor senator Tony Sheldon said the system has become a “rort” under the coalition government with Aussies avoiding tax which could be used to fund health and infrastructure.

“Whose side is the prime minister on? The side of people who need Tiffany platinum bracelets and Gucci bags who are willing to rort the system? Or the rest of us?” he told parliament on Monday, according to SBS.

After Chinese passport holders, Aussies were the second biggest claimants in 2017-18.

The largest claim on record was paid to a foreign national in October 2011, who was given nearly $250,000 on a $2.6 million purchase.

Latest News

Holland America Line gives agents the chance to visit Alaska on 11-day Famil

If you've ever wanted to see a Polar Bear (and who doesn't?), now is your time.

More than 65 luxury agents gather in Sydney for Best of the Best dinner

This looks like a fabulous do. We imagine there may be a few (or maybe 65) sore heads this morning!

Globally-renowned chefs gather for Vivid Food 2024

As a human, we agree that food is a fundamental part of the human experience. Some might say the most fundamental.

Air New Zealand returns to Hobart and Seoul

If you notice an uptick in Kiwis making their way through the Mona, you know why.

European Waterways targets multi-generational families with ‘floating villa’ deal

The jury is still out on whether spending a week on a 'floating villa' with family is a hell or a paradise.

Luxury Escapes launches ‘sail away’ sale

Rest assured, you'll be getting your 'sails' and 'sales' mixed up for the rest of the day.

Rex-owned National Jet Express adds weekly charter between Brisbane and Orange

This is for mining and civil contractors, so please, put your holiday attire away.

Let the games begin. Viking introduces eye-watering benefits for the industry’s top 10 advisors

Did someone say 'trip to Venice'? Hold my coat, this one is far too good to miss!

Best friends or frenemies? What is the REAL relationship between sales and marketing?

We can all stop fighting over the corner office because our mothers were right - we are all important in our own way.

The Walshe Group Announces Two Key Appointments

What we really want to know is whether they got joint or separate welcome parties.

FAMIL: Agents explore the delights of Mauritius on 7-day tour

Go green with envy as you read this fabulous itinerary! Time to book that second honeymoon.

Hamad International recognised as world’s best airport at 2024 Skytrax World Airport Awards

Hamad airport is so good it is almost considered a destination in itself. Ballina, up your game.

Saudi Arabia highlights tourism investment opportunities at global investment event

Now is the time to start looking at Saudi Arabia if you are not already. There's big things to come.

“Rampant” – Aussies warned as dengue fever cases spike in Bali

Worried about Bali belly? Now you have something else to worry about.

TTC Tour Brand reveals slew of deals across operators including Trafalgar and Contiki

Everybody loves a bargain and you could do lot a lot worse than check out these deals from TTC!

Fiji Airways partners with Porter Airlines in US growth bid

Any initiative that gets more people visiting the delights of Fiji is a good initiative.

Flight Centre launches CruiseHQ – a marketplace exclusively for agents

The cruise industry has surpassed pre-Covid levels so this isn't one to miss!

Feeling festive? Wendy Wu tours unwraps Christmas collection

Get the Christmas hols booked now and avoid spending it with that elderly relative with dubious political views.

OPINION: In a world of screens, we crave experience

If you get feelings of deep shame and regret when you see your screen time, don't worry - you're not alone.

Sun Princess: High-end dining and world class entertainment awaits

If you are a foodie and you are not currently on the Sun Princess, we really have to ask - what are you doing?

YouGov: 2 in 5 Aussies would pay more for a sustainable hotel

If you want to be REALLY sustainable you can go camping. You just might lose the will to live.

“Can planes swim?” – Planes become boats as Dubai Airport is savaged by severe storm

Unfortunately, "can planes swim?" is a real life question and not an opener to a really bad joke...

Explora journeys reveals bespoke outdoor furniture designed by Matteo Nunziati

This is making your plastic table and chairs look really bad now, isn't it?

Bangkok Airways targets growth with renewed Sabre deal

Two stories abut Sabre's growth in one week and its only Wednesday! Watchout world.

PR agency Example wins pitch for InterContinental Sydney

We also went in for the contract but they said that a 'Be Our Guest'- themed TikTok was unoriginal! The cheek.

Norwegian Cruise Line reveals culinary experience aboard Norwegian Aqua

Once again, this TW journalist REALLY regrets writing this before getting lunch.

Signature Queensland hosts luxury tourism event

Known for its tropical beaches and unique wildlife, Queensland also offers luxury.

Capella Sydney recognised in prestigious Travel + Leisure’s 2024 ‘it list’ of best new hotels

You know that 'it girl' at school who everyone wanted to hang out with? Capella is the hotel version of that.

Rex launches 72-hour fare sale with NO school holiday blackout so you can take your kids (if you want to)

Sadly, leaving your children at home whilst you go on holiday is generally frowned upon.

Adventure World offers chance to connect with “heart and soul” of the US

I mean who hasn't dreamed of a road trip around the US?! Go with Adventure World and you're less likely to get lost.

Fiji’s family-owned luxury resort Likuliku Lagoon launches its own app

We were relieved to find out that having a "concierge in your pocket" referred to an app on your phone.

Hawaii: The US’ laid-back front door for Australians

If you needed another sign that you should definitely head to Hawaii - this is it!

Sabre targets Asia Pacific growth with latest hire

Call the Avengers! Sabre continues its bid for world domination with latest hire.

Air New Zealand signs its largest EVER deal for sustainable aviation fuel

Air New Zealand makes huge step towards sustainable travel. We bet it recycles its rubbish properly too.

IHG Hotels & Resorts continues regional growth with Sunshine Coast Holiday Inn

This Holiday Inn looks considerably flashier than some of the ones we have stayed at in our time.

Budget carrier Scoot welcomes first of 9 E190-E2 aircrafts

Here at TW we would like to offer Embraer E190-E2 a warm welcome! It's not easy being the first of the fleet.